What is my business worth? It’s the million dollar question that every small business owner eventually asks. Or, is it the three million dollar question? Or maybe it’s the seven million dollar question? And therein lies the problem: How do you figure out what your most valuable asset is worth?

It’s relatively easy to estimate the value of many of your assets. A quick comparable market analysis (CMA) will get you an approximate value of any real estate you own. You get a quarterly statement in the mail telling you what your retirement account is worth. And the Kelley Blue Book tells you what buyers will pay for your vehicles. But where can you look up the value of your small business? Unfortunately, the answer is nowhere.

In this article, we’ll discuss a bit about how businesses are valued, and what DIY methods to avoid. We’ll provide a quick method, along with examples, for estimating the value of your business. We’ll also offer some insights into what pushes the value of your business up, and what can drag it down in the eyes of a buyer.

Disclaimer: The goal of this exercise is to give you a ballpark number as well as an introduction to the fundamentals of how real-world buyers, investors, and other outsiders assess the value of a business. In no way should this be used in place of a full business valuation performed by a trained professional. With that said, this quick business valuation exercise should give you a ballpark number, and act as a reasonable starting point.

Who this article is for: This article is for small business owners who have built a historically profitable lower middle market business (annual sales $2M to $25M) structured as a pass-through entity such as a limited liability company (LLC) or an S corporation.

Every Small Business Has Many Different Values

What is my business worth? The honest (albeit annoying) answer is: It depends who’s asking. A small business can have many different values based on who wants to know, and why. Here are just a few examples:

- Liquidation value

- Asset value

- Book value

- Enterprise value

- Insurance value

- Fair Market value

- Strategic value

- Fractional value

- (You get the point)

In this article, we’re going to focus on the market value of a 100% ownership interest in a small business. Put another way, we’ll get an approximation of the sale price of the business in a scenario where the entire business is purchased by an outside buyer as a going concern (i.e., the business is operating as normal and will continue to do so with the new owner).

It’s worth mentioning that the vast majority of businesses in the lower middle market are valued based on historic earnings derived from the last three years’ financial statements. Startups and high-growth companies, on the other hand, typically use valuation methods that are forward looking. These include discounted cash flow, and other methods based on the net present value of future cash flow.

Avoid These DIY Valuation Methods

Before we dive into a quick way to get a good ballpark idea of your business worth, let’s highlight a few methods you’ll want to avoid. These include:

- Using your own method based on what you think is correct

- Pegging the business’s value to whatever you want or need

- Relying on an online business valuation calculator

- Using a multiple or percentage of revenue

- Using asset values derived from the Balance Sheet

- Using hybrid values from the P&L and Balance Sheet

- Using any method not based on net income from operations

- What your friend said it’s worth based on the sale of their business

- What anyone who is not intimately familiar with valuation says it’s worth

There is a huge danger in getting attached to a number or methodology that is incorrect (i.e., a common cognitive bias called the anchoring effect). For most business owners, the business is their most valuable asset. Thinking it is worth significantly more or less than it is can lead to all kinds of problems down the road – from turning down a fabulous offer from a great buyer, to leaving large sums of money on the table.

How Do You Value A Business Quickly? Like This

Following is an intentionally simplified version of how potential buyers look at a business for sale. This uses a market approach that is based on cash flow – pre-tax earnings from operations more accurately – and a multiple of earnings that is appropriate for similar businesses. Let’s look at the cash flow first.

Step 1: Get Your Income Statements For The Last Three Years

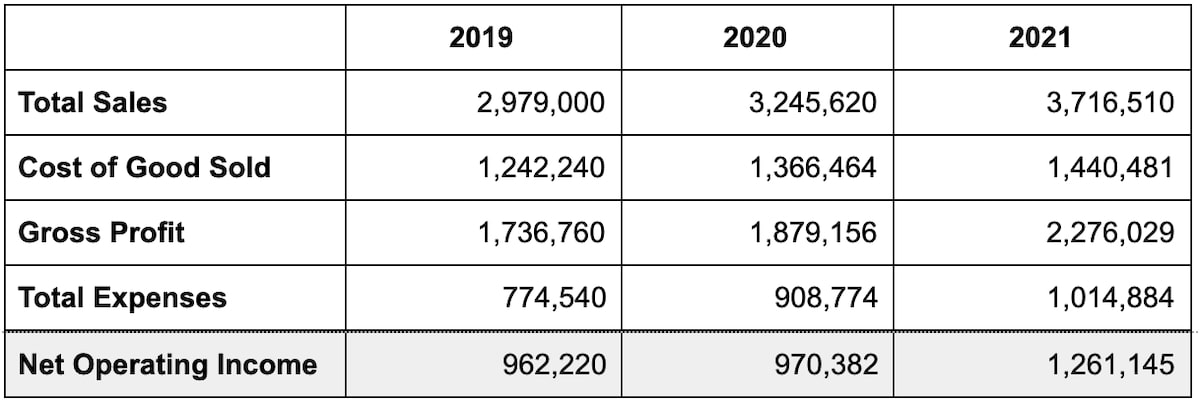

Pull your Income or Profit & Loss Statements (P&L’s) for the last three years on a cash basis. Put them side by side so that they look like this.

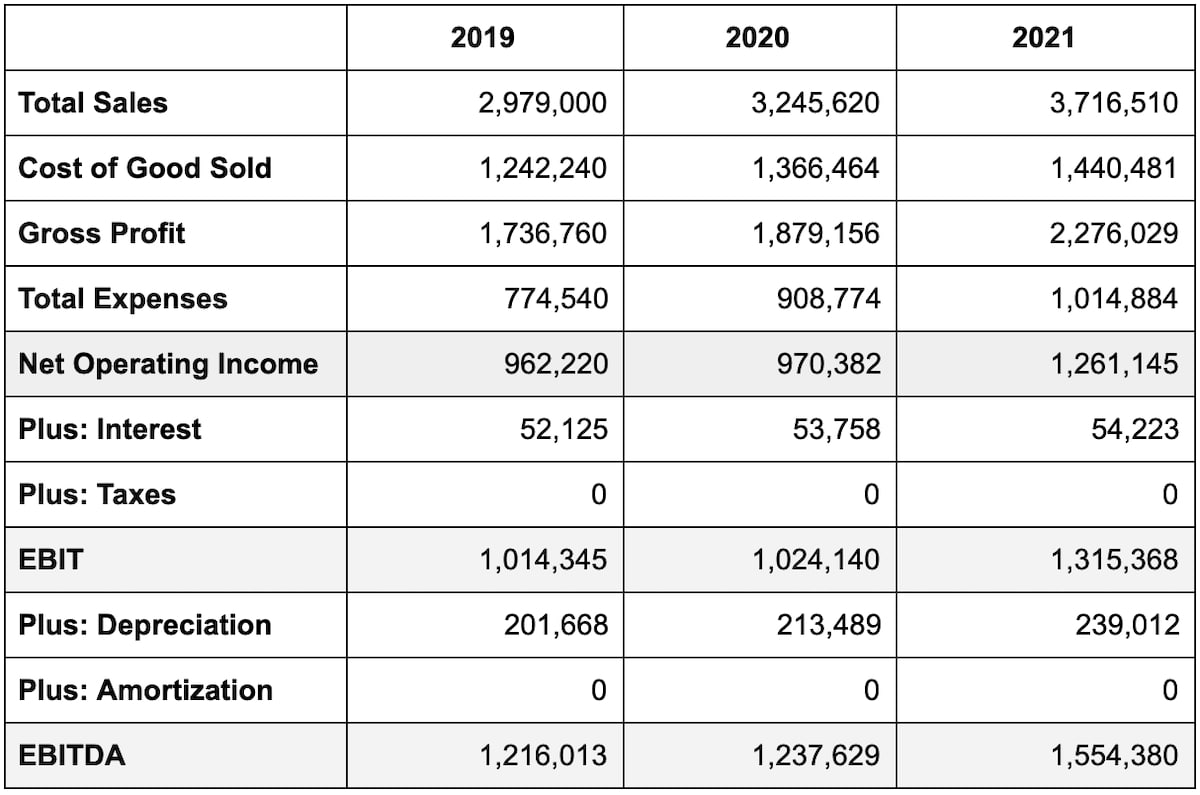

Step 2: Calculate EBITDA

The first earnings metric that you’ll want to calculate is Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA).

What about adjustments to EBITDA for the owner’s salary and discretionary expenses, I hear you asking? In this article, we’re going to stick with EBITDA to get a quick ballpark number.

Calculating adjusted EBITDA – sometimes referred to as Seller’s Discretionary Earnings (SDE) in the lower middle market – is where you’ll need the help of a professional. There are too many variables at play, and it’s too tempting for owners to go crazy with adjustments and add back expenses that potential buyers would never allow.

Step 3: Calculate 3-Year Average EBITDA

Next, take a 3-year average of EBITDA. Using our example that would be $1,336,000.

Step 4: Apply a Multiple to Your 3-Year Average EBITDA

Once you have a three-year average for EBITDA, you’ll need to apply a multiple.

According to the Pepperdine 2020 Private Capital Markets Report, the average multiple across all industries for a business with $1M in EBITDA was 3.9.

Value = 3.9 x $1,336,000 = $5,210,000

Most business brokers and merger and acquisition (M&A) advisors will tell you that the average multiple for businesses with $1M in EBITDA or less is in the range of 3.0–5.0. In our experience, 5.0 or 6.0 is the top of the range that many private equity groups will pay. A multiple below 3.0 for a lower middle market business usually signals that the business is in an undesirable industry, or comes with a high level of risk.

Don’t let anybody tell you what a strategic buyer will pay for your business: The strategic buyer is the only one who knows for certain. Strategic value is based on the acquirer’s own internal metrics and methodology, something that is typically not public information. And every company’s investment thesis is different.

Lastly, rules of thumb are generally OK in a simple calculation like this, although they need to come from a credible source like the Business Reference Guide (BRG). The BRG is updated annually and includes rules of thumb from business brokers with industry-specific expertise.

Business Valuation Is Both Art and Science

There are many subjective factors that play into valuing a business. While this little exercise may be helpful, there is still much that needs to be determined about the value of any business. Here are just a handful of questions that still need to be asked:

- How will the value of working capital be treated?

- What are the risks associated with this business?

- What are the risks associated with this industry?

- How integral is the owner to daily operations?

- How do operating ratios compare to industry averages?

- Does one customer account for more than 10% of annual sales?

All of these questions and many others could have an enormous impact on how potential buyers view the business and ultimately arrive at a purchase price.

Unlike many tangible assets, the value of a business – the bulk of which is often in the value of intangible assets like Goodwill – is a moving target: It can change on a monthly or even daily basis. A change in the company’s operating performance or capital structure will change the analysis. Likewise, different buyer types may use different valuation methods that are unique to their acquisition goals.

Get a Business Valuation Sooner Rather Than Later

At the end of the day, your business is worth what a willing and able buyer pays for it. Everything else is pure speculation. A thorough valuation process led by a trained professional can get you pretty close though. Absent that, this exercise will at least give you a logical starting point.

Many entrepreneurs think they don’t need to get a business valuation – or even know the value of the business – until they’re ready to sell. Yet nothing could be further from the truth!

You’ll want to get your business valued at least a year or two before you plan to initiate a sale process. This allows you time to prepare your business for sale and address any issues that crop up during the analysis, like closing a valuation gap.

If you’re ready to find out what your most valuable asset is worth, the advisors at Allan Taylor & Company have the experience and know-how to help. Reach out to us today.

Barbara Taylor is the co-founder of Allan Taylor & Co. You can connect with her on Twitter @ballantaylor and LinkedIn.