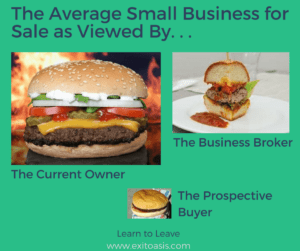

If you follow me on social media, you’ve doubtless seen a lot of shared content from Mike Finger of Exit Oasis. Mike is a business owner who has lived through the selling process and now advises other owners on “learning to leave” their business. Mike’s blog posts have a refreshing combination of candor and comedy. He’s prolific on social media, as well. If you’re not following him on Twitter and Facebook, you’re missing out on cheeky memes that deliver nuggets of wisdom with a good belly laugh. Here’s one of my favorites:

I agree with Mike on 99% of the things he writes, and when I disagree we chat about it. (You can view our conversations on LinkedIn, by the way.) I recently reached out to Mike to get his unique spin on a few of my favorite topics, including the myths associated with selling a business, the value of business valuations, and what the heck is wrong — and right — with the business brokerage industry. Settle in with a cup of coffee and enjoy!

BT: You say on your website that you owned a successful business, but after growing it to 50 employees over a ten-year period you discovered it was unsellable. How did you find out your business was unsellable (i.e. who told you), and what were the primary characteristics of the business that made a sale difficult or even impossible?

Oh, what an ugly day. Here’s how I got there.

After 10 years of ownership I had a competitor who expressed interest in buying the business. I put together a fancy packet of information for him and waited anxiously to hear his fabulous offer. After a short delay, we received a polite “no thanks” without a lot of explanation. Something was off. His response didn’t make sense, as I knew my business was very valuable.

That prompted me to reach out to a few business brokers to get confirmation of my “high business value.” After the third broker said, “I don’t think we can help you”, it became clear something was wrong. Here’s what I found out:

- I’d prioritized growth over profit. I thought that revenue actually mattered when valuing my business. I’d read an article that said we’d sell for 1-2 times sales, so I chased revenue. We had $5 Million in revenue, but no profit.

- I thought self-sacrifice was the key to building value, so I paid myself very little the first 10 years I owned the business. I never asked myself if that poverty lifestyle would be attractive to a buyer.

- The business was extremely dependent on me. I had my hands in everything. Without me…no business, and that’s not an easy reality to sell.

Need I go on? It took several years to change the business so we could make the exit we wanted.

BT: You and I both like to debunk common myths about selling a business. What do you think are the top misconceptions about selling that really do a disservice to business owners?

The destruction I see comes from two false assumptions owners have.

#1 My business is sell-able.

Owners, by default, believe they have a sellable business. They don’t understand that the great majority of businesses are unsellable in their current condition.

- The odds on selling a small business prove this.

- Broker experience in selling small businesses proves this.

- Owner experience in trying to sell proves this.

Yet most owners believe they own a business they could sell, and no one tells them otherwise until it’s too late.

The problem is that the “sell a business” industry is not compensated by convincing owners their business is unsellable. Quite the opposite. Brokers, valuation experts, exit planners…they all earn from owners who believe they can sell. Accordingly, most of the content and advertising produced reinforces the myth that “you can sell…if you work with us”. Owners who are not ready to sell hear only the “you can sell” part of that message. It feeds their belief in assumption #1, which leads them to the second destructive assumption.

#2 Since my business is sellable, I can wait until I am ready to sell to engage the topic.

If an owner believes their business is already sellable, they get to push learning about several things off into the future.

- How to sell?

- What makes a business sellable?

- How long does it take to change a business to make it something a buyer might buy?

An owner can ignore these questions, and a hundred more, if they believe their business is inherently sellable. They put off these questions until they are ready to sell, and only then learn how wrong they are.

BT: Neither one of us is shy about criticizing the business brokerage industry. Yet, at the end of the day I think we both agree that the right intermediary can add a ton of value to the sale process. If you could stand in front of a room filled with business brokers, what’s the one message you’d like to get across? (I’d hold the door open while you run out the back, by the way.)

A room full of brokers…yikes.

Surprising as it might be to some, I’m actually quite sympathetic to the challenges business brokers face. I think it’s a tough job. Owners who want to sell are a crazy bunch. They bring the assumptions mentioned above, plus 100 unrealistic goals, and then demand a commissioned broker make all their selling dreams come true. We haven’t even mentioned the challenges of dealing with buyers. Being a broker is a tough job.

That said, there are too many brokers who deal with the real challenges of the job by blurring ethical lines and treating people like garbage. I’ve had some really lousy experiences with brokers, but also some great ones where the broker added incredible value.

If I could wave a magic wand…I’d have to aim it at the compensation structure brokers work under. I believe the commission structure has an incredibly negative impact on how owners feel about brokers, and in how brokers treat owners. That said, I don’t really have an alternative to offer, especially for truly small businesses.

But without question, the commission structure is one of the reasons it’s ok to hate business brokers.

BT: We both agree that business valuation tends to miss the radar of most business owners until it becomes a necessity for some reason. What’s your best argument to business owners to convince them that enterprise value — i.e. what an outsider would pay for your business — is a metric they should not only know, but track?

Two opposing answers on this one:

Over $5 Million Revenue: 100% agree. The business represents a massive investment for the owner, and an updated understanding of the market value is critical. I don’t rely on my private opinion of value to establish the price of my stock holdings, because I know only the external market value of that stock matters when it comes time to sell. The same is true for a business, but most owners rely on their own opinion to establish the value of their business and then manage accordingly. The ROI available to owners who view their larger business to maximize enterprise value is substantial.

Under $5 Million Revenue: While the information from a valuation can still be valuable, given the cost of a valuation it can be challenging for small businesses to justify. I encourage owners at this level to take the short-cut. I think these owners can benefit from an annual “free valuation” from a business broker.

Valuation experts hate this advice. They want owners to view the “free valuation” as trash. But for the small owners, the numbers don’t add up if they pay for the valuation. If I cash-flow $100K a year in my small business, it doesn’t make sense to spend 5-10% of that to get a formal valuation to check my market value? However, an informal valuation from a broker can help me touch some of the same areas and double check on value direction.

BT: One of my pet peeves about advisors (CPA’s, attorneys, financial planners) is that they have a tendency to tell business owners what they think they want to hear. I’m a big fan of ripping off the band-aid and getting the truth — good, bad or otherwise — out in the open as soon as possible. What is your biggest pet peeve about small-business advisors when it comes to their role in helping owners with exit planning?

Selling a business is a human process. Too often I think it’s treated as purely a technical exercise by inexperienced, or ineffective, advisors.

- The accountant understands the tax implications of the sale, but doesn’t understand that their new calculation means the seller can’t afford to retire where they want to.

- The attorney explains the legal technicalities of the purchase agreement, but doesn’t understand the emotional impact on the owner of separating from the business.

- Financial planners accept the owner’s assumption that the business can be sold. So, they focus on planning for “what we’ll do when the business sells” instead of advocating for a fallback retirement plan because they understand that most businesses won’t sell.

Too many advisors close a few deals, establish some basic technical competence, and think they are ready to fully support an owner. While we’re all learning as we go, I’m a huge advocate for using advisors who have been there before. Brokers who owned a business, accountants who own their own firms, etc.

Barbara, you’re a great example of this in action. Highly skilled technically, but you clearly have a sensibility and understanding of what the owner’s journey is – that perspective is invaluable in an advisor.

Owners need to find an advisor who understands that selling the business is real life for business owners.