In 2015 I wrote a blog post for Forbes titled Did the Recession Hijack Your Exit Strategy? There were many business owners who were either unable to exit their business — or had to postpone their exit date by several years — as a result of the Great Recession. In the case I wrote about it took almost six years for the owner to rebuild and exit her business.

Like a lot of us, I’m seeing some parallels between now and the 2008 financial crisis. Yet now also feels entirely different.

I found myself wondering how business owners were feeling about plans they may have had to sell their business (or exit via another strategy) before COVID-19 hit. One advisor friend said he thought nobody was thinking about selling their business right now. I disagreed.

Rather than speculate, I decided to ask a few business owners myself by creating a simple survey. I shared the survey with my network the week of April 27th and got 39 responses. Here are six highlights from the results.

[Full results are in the Infographic. If you’re pressed for time, there’s a short Summary at the end of this post.]

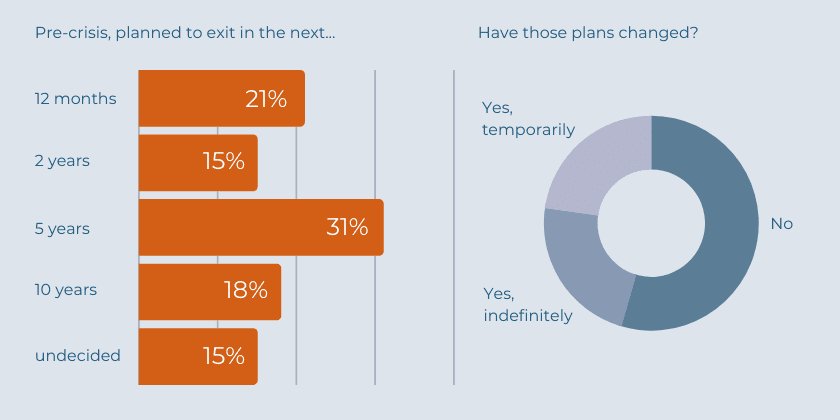

1. Prior to COVID-19, when were you planning to sell or exit your business?

Over 40% of small businesses in the U.S. are owned by Baby Boomers. The youngest of the Boomers are 56, while the oldest are turning 76 this year. Demographics alone would suggest that there are many owners reaching a point where they are ready — or almost ready — to sell their business.

It’s not surprising that 31% or respondents planned to leave within the next five years, and 36% planned to sell in two years or less. A 2018 survey mentioned in Forbes had similar results, with 32% of owners surveyed saying they planned to sell their business in the next two years.

TAKE-AWAY: There will be a lot of business owners looking to sell or exit in the next five years. Keep this in mind as you choose an exit timeframe and work towards going to market and selling your business. You may want to either accelerate your go-to-market date, or delay it significantly and build value.

Whatever your timeline, make sure you’ve prepared your business for the sale process before hitting the market. A sale-ready business stands out in a crowded marketplace, attracts high-quality buyers and sails through the due diligence process.

2. How has COVID-19 affected your plans to sell or exit your business?

This result paints an optimistic picture! Most of the business owners in our survey are forging ahead with their plans to sell or otherwise exit their business. There were as many owners who believe their exit plans are simply on hold temporarily as there were owners whose plans have been scuttled indefinitely.

Digging a bit deeper into the majority who don’t see their plans changing, 43% plan to sell in the next two to fives years, while only 9% were planning to sell in the next 12 months. A whopping 71% of the businesses in the “no change” category had been established for 15 years or longer.

TAKE AWAY: Only 5% of our respondents owned businesses that were less than five years old. Selling a business is often a function of personal timing: Most owners decide to sell when they feel ready to move on. The problem with “waiting until you’re ready” is that you often miss an ideal window of opportunity to sell (also known as the last five years).

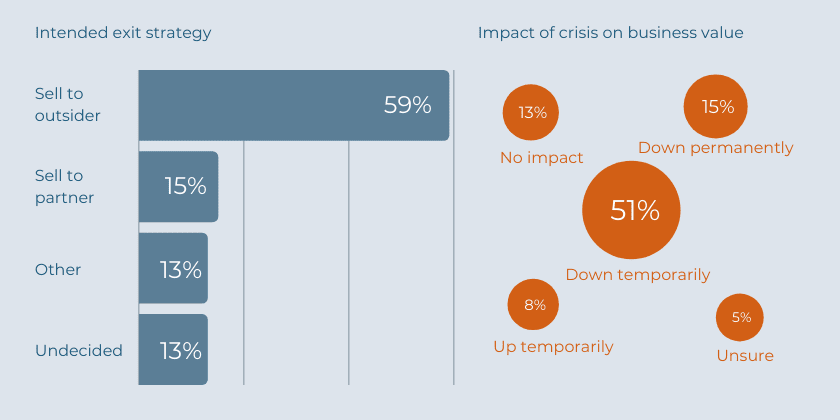

3. Prior to COVID-19, what was your intended exit strategy?

I admit that many of the owners in our network are the type who plan to exit by selling the business to an outside buyer. Perhaps it’s no surprise that not one respondent had plans to either sell or gift their business to a family member.

Regardless, I’ve been seeing this sentiment in similar surveys for years. The tradition of passing the business down to the next generation seems to be on the wane. One reason is pretty straightforward: they don’t want it. In this 2018 UBS survey 82% of business owners said their children would rather inherit the assets from the sale of the business than the business itself.

Add to that there is now plenty of data telling us that generational business transfers have a low success rate of about 30%, although it depends how you define success. [TIP: If you do plan to leave your business to your children, prevailing wisdom says that it requires a ten-year transition period. Start early and hire the right advisors to help you with what is a notoriously difficult process. Also, read this book immediately.]

TAKE-AWAY: If you think you’re in the minority because your preferred exit strategy is selling to an outside buyer, you’re wrong. In fact, it is the preferred strategy for most small-business owners. However, most owners do not take the time to properly plan and prepare the business for a sale. Increase your odds of success by starting the planning process (with advisors) at least two years prior to selling.

4. How do you think COVID-19 will impact the value of your business?

Respondents seem to be optimistic about their ability to quickly recover any lost business value. Only one respondent thought it would take at least three years to get back to a pre-crisis value.

The question of how to account for the impact of COVID-19 has been a hot topic in the business valuation and M&A communities. When it comes to business valuation for the purpose of selling a business, I think the answers will lie in how, when and to what degree a business recovers.

TAKE-AWAY: I can see the day coming when “how did your business deal with COVID-19?” becomes part of every due diligence process. Track pandemic-related expenses (and income, if you’re in the camp who is doing well right now) so that you can paint a clear picture of what happened to potential buyers. Businesses that bounce back quickly — and use this time to pivot or make positive changes to the business — will preserve value and have a compelling story to tell.

If you’ve never had your business valued, you may want to think about getting a business valuation dated 12/31/2019. Why? Because going forward the financial performance of your business will be analyzed in terms of pre and post-crisis. In fact, I’m already seeing the term EBITDAC (Earnings Before Interest, Taxes, Depreciation, Amortization and Coronavirus) being used.

A business valuation for YE 2019 will not only give you EBITDAC for your business, it will also provide a benchmark for getting value back to pre-crisis levels, and beyond.

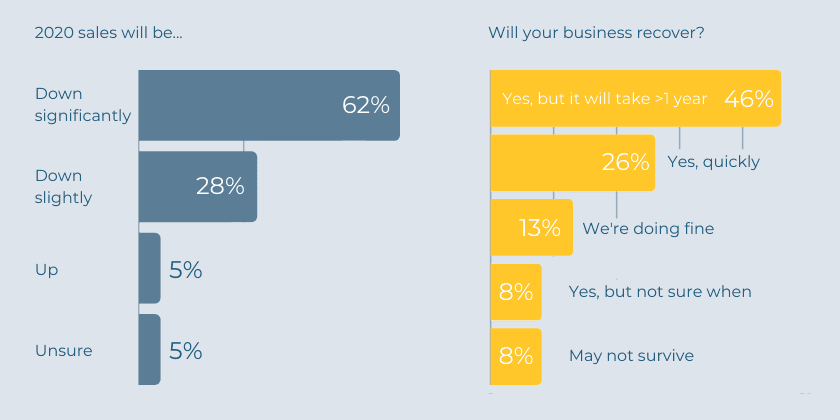

5. How will COVID-19 impact 2020 Sales at your business?

There were no surprises here: Most owners see their business taking a big hit to the topline this year.

6. How do you expect your business to recover from COVID-19?

Most owners are optimistic about their business recovering, although the majority believe it will take upwards of 12 months. Still, almost 40% either believe their recovery will take less than a year, or are in a position where they won’t need to recover at all. Just 16% feel the prospects for their business recovering are bleek.

TAKE-AWAY: If you’re going to be spending the next year or so getting your business back on track, this is a great opportunity to make some changes that will increase value and sellability. No doubt you’ve become laser-focused on cash flow, something you may not have paid much attention to in the past. Continue to focus on cash flow and other metrics in your business that impact value.

Take a hard look at every aspect of your business. Now is a good time (or a good excuse, if you need one) to streamline, right-size, clean house. Invest time and money into value drivers like better financial management, documenting processes and systems, updating technology — like the tools that enable remote work) — diversifying suppliers and customers, and shedding unprofitable products or services.

SUMMARY: My main take-aways from the survey are that most established businesses are taking a hit this year, but are confident in their ability to recover. For many it will take longer than 12 months, although for some the recovery period may be quicker or even unnecessary. A minority of businesses will see value decrease permanently, have a longer road to recovery, or may not survive. A lucky few are doing well as a result of the pandemic. Owners are still thinking about a future sale or exit, and are either moving forward with their plans or simply hitting the pause button until the dust settles.

I still have one final question. Has the current crisis motivated business owners to finally get serious about planning for a future sale or exit? I can still hear an echo of the words so many business owners said during the 2008 financial crisis: “I never want to live through this kind of thing again.”

We’re ready to help you plan and prepare your business for a sale, whether you’d like to sell ASAP or in the next 6-36 months. Let’s talk.

Photo by Onlineprinters on Unsplash